Introduction to Income Tax

Income tax stands as a cornerstone of fiscal policy, serving as a critical source of revenue for governments worldwide. In the Indian context, the intricacies of income tax play a pivotal role in shaping the nation’s financial landscape. Levied directly on individuals and entities based on their earnings, income tax embodies the principles of economic equity and social justice.

Enshrined in the Income Tax Act, 1961, India’s taxation framework delineates the contours of this levy. It categorizes income into various heads, encompassing salary, business profits, capital gains, and more. The progressive tax system, characterized by distinct slabs and rates, reflects a nuanced approach to wealth distribution.

How to Get Maximum Benefits of Credit Card 2023

As taxpayers navigate the labyrinth of exemptions, deductions, and filing procedures, income tax becomes not only a financial obligation but a dynamic element influencing economic behaviour. The revenue generated fuels public infrastructure, social programs, and developmental initiatives, underscoring the symbiotic relationship between citizens and the state.

In this ever-evolving landscape, staying abreast of amendments, understanding the types of income, and strategically leveraging deductions become integral aspects of financial literacy. This introduction sets the stage for a comprehensive exploration of income tax in India, delving into its nuances, impact, and the obligations it places on individuals and businesses alike.

Income Tax Slabs and Rates

As of my last knowledge update in December 2023, the income tax slabs were as follows for individual taxpayers below 60 years of age. However, tax laws are subject to change, and I recommend checking the latest updates or consulting with a tax professional for the most current information:

New Income Tax Slabs as per Union Budget 2023:

| Income Tax Slab | Income Tax Rates Applicable for FY 2023-24 as per the new regime for HUF and all Individuals |

|---|---|

| 3,00,000 | No Tax |

| 3,00,001 to 6,00,000 | 5% |

| 3,00,001 to 6,00,000 | 10% |

| 9,00,001 to12,00,000 | 15% |

| 12,00,001 to 15,00,000 | 20% |

| Above 15,00,000 | 30% |

NOTES:

The tax rates in the new tax regime remain the same across all categories, i.e. the Hindu Undivided Family and individuals up to 60 years of age, senior citizens above 60 years to 80 years of age, and super senior citizens above 80 years. Therefore, no increase of the basic exemption limit will benefit the senior and the super senior citizens in the new tax regime.

Individuals with a net taxable income of up to ₹ 7 lakh will be eligible for tax rebate u/s 87A under the new tax regime. The rebate limit remains at ₹ 5 lakh for individuals who choose to pay tax under the old regime.

Please verify the latest income tax slabs from a reliable source or the official website of the Income Tax Department for the most accurate and up-to-date information.

How to Get Cheap and Best Bank Personal Loan in 2023

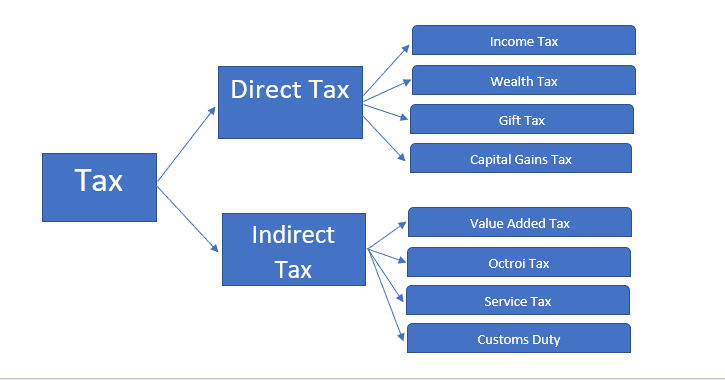

Types of Income tax

Income tax in India encompasses various types of income, each falling into specific categories. The major types of income considered for taxation include:

1. Salary Income:

Earnings received by an individual for services rendered, including basic salary, allowances, bonuses, and perks.

2. Business Income:

Profits generated from a business or profession, after deducting allowable expenses. This includes income from self-employment and freelance activities.

3. Capital Gains:

Profits arising from the sale of capital assets (such as properties, stocks, mutual funds, or other investments). Capital gains are categorized into short-term and long-term based on the holding period.

4. House Property Income:

Rental income from owning a property is considered taxable. However, certain deductions are available, such as standard deduction and interest on home loans.

5. Other Sources of Income:

This category includes income from various sources like interest on savings accounts, fixed deposits, dividends, and winnings from lotteries or games.

6. Income from Agriculture:

Generally, agricultural income is exempt from income tax. However, if it exceeds a certain limit or is derived from non-agricultural operations, it may become taxable.

7. Foreign Income:

Any income earned abroad by an Indian resident is subject to taxation in India. Tax credits may be available for taxes paid in foreign jurisdictions.

8. Pension Income:

Income received as a pension, whether from a former employer or other sources, is taxable.

9. Gifts and Inheritance:

While gifts received from specified relatives are exempt, gifts from non-relatives exceeding a certain limit are taxable. Inheritance, however, is generally not subject to income tax.

It’s essential for taxpayers to understand the nature of their income and the applicable tax rules. Various deductions and exemptions are available to reduce the overall tax liability, making it crucial for individuals to explore these options within the framework of the Income Tax Act.

Deductions and exemptions

Deductions and exemptions in the Indian income tax system are available from various sources, providing taxpayers with opportunities to reduce their taxable income. Here are some common types and sources of deductions and exemptions:

1. Section 80C Deductions:

- Investments in Provident Fund (PF)

- Life Insurance Premiums

- Equity-Linked Savings Schemes (ELSS)

- National Savings Certificates (NSC)

- Public Provident Fund (PPF)

- Repayment of Home Loan Principal

- Tuition Fees for Children’s Education

2. Section 80D Deductions:

Premiums paid for Health Insurance Policies

3. HRA (House Rent Allowance) Exemption:

Individuals who receive HRA as part of their salary can claim exemptions on the rent paid for accommodation.

4. Standard Deduction:

Salaried individuals can avail a standard deduction from their salary income.

5. Leave Travel Allowance (LTA):

Exemption for expenses incurred on travel within India for oneself and family.

6. Section 24 Deductions:

Interest paid on Home Loan is eligible for deduction under Section 24.

7. Section 10 Deductions:

Various allowances like House Rent Allowance (HRA), Leave Travel Allowance (LTA), and more are covered under this section.

8. Section 80E Deductions:

Interest on Education Loan for higher studies is eligible for deduction.

9. Section 80G Deductions:

Donations to specified charitable institutions are eligible for deduction.

10. Section 80TTA and 80TTB Deductions:

Interest earned on savings accounts and fixed deposits for senior citizens is eligible for deduction.

It’s crucial to note that the availability and limits of deductions and exemptions may vary, and taxpayers should refer to the latest provisions of the Income Tax Act or consult with tax professionals to ensure accurate and updated information. Additionally, the government may introduce changes to these provisions, so staying informed about updates is essential.

Tax Filing Process – click here

5 Areas Where Interest Rates Affect the Real Economy

Advance Tax

Advance tax is a system of staggered payment of income tax by taxpayers before the end of the financial year. Instead of paying the entire tax liability at the year-end, individuals, professionals, and businesses are required to pay advance tax in installments. This is particularly applicable to those whose total tax liability for the year exceeds a specified threshold.

The advance tax payment schedule typically has installments due at specific intervals during the financial year. Failure to pay advance tax on time may result in interest charges. It is a way to ensure a regular inflow of revenue for the government and helps in avoiding a last-minute rush for tax payment.

Tax Deducted at Source (TDS):

TDS, or Tax Deducted at Source, is a mechanism where a person making specified payments such as salary, commission, rent, interest, etc., deducts tax at a certain percentage before making the payment. The deducted amount is then deposited with the government on behalf of the payee.

TDS is essentially a way to collect taxes at the source itself, ensuring a steady collection of revenue for the government. It is applicable to both individuals and businesses. Common examples of TDS include the tax deducted by employers from employees’ salaries and the TDS deducted by banks on interest income.

Recipients of such payments receive the net amount after TDS deduction, and they can claim credit for this TDS while filing their income tax returns. TDS rates vary depending on the nature of the payment and the provisions of the Income Tax Act. It is crucial for both the deductor and the deducted to comply with TDS regulations to avoid penalties and ensure smooth financial transactions.

Penalties and Consequences on Income Tax Non-compliance

Income tax non-compliance in India can lead to various penalties and consequences. It is imperative for taxpayers to adhere to the rules and deadlines to avoid legal repercussions. Here are some key penalties and consequences:

1. Late Filing Penalty:

Consequence: If a taxpayer fails to file their income tax return by the due date, a late filing fee may be imposed.

Penalty Amount: The penalty amount varies based on the time of filing and the taxpayer’s total income.

2. Underreporting of Income:

Consequence: If the income declared in the return is found to be less than the actual income, penalties can be levied.

Penalty Amount: Penalties can range from 50% to 200% of the tax payable on the underreported income.

3. Non-disclosure of Assets:

Consequence: Failure to disclose assets, particularly foreign assets, can result in penalties.

Penalty Amount: Penalties can be imposed, and in some cases, prosecution may be initiated.

4. Non-payment of Advance Tax:

Consequence: Taxpayers with a tax liability exceeding ₹10,000 in a financial year are required to pay advance tax. Non-payment can lead to penalties.

Penalty Amount: Penalties are levied at a specified percentage of the unpaid tax.

5. Incorrect Information:

Consequence: Providing incorrect details or false information in the tax return can lead to penalties.

Penalty Amount: Penalties may be imposed based on the nature and extent of the incorrect information.

6. Non-compliance with Notice:

Consequence: Ignoring income tax notices or failing to respond to them appropriately can lead to legal consequences.

Penalty Amount: Penalties may be imposed, and further legal actions may be initiated.

7. Failure to Maintain Records:

Consequence: Taxpayers are required to maintain financial records. Failure to do so can result in penalties.

Penalty Amount: Penalties may be levied for non-compliance with record-keeping requirements.

8. Prosecution for Serious Offenses:

Consequence: In cases of severe non-compliance or tax evasion, prosecution proceedings may be initiated.

Penalty Amount: Legal action can lead to fines, imprisonment, or both, depending on the severity of the offense.

9. Seizure of Assets:

Consequence: In extreme cases, authorities may seize assets for non-compliance with tax regulations.

Penalty Amount: The value of seized assets may be considered in settling tax liabilities.

4 Best Options To Get A Loan With Bad Credit Score

It’s crucial for taxpayers to stay informed about their obligations, file accurate returns on time, and address any discrepancies promptly to avoid penalties and legal consequences. Consulting with tax professionals can provide guidance tailored to individual circumstances.

Recent Changes and Updates

Tax laws are subject to amendments. Stay updated with the latest changes, exemptions, and deductions introduced by the government.

Conclusion About Income Tax

In conclusion, Income Tax in India stands as a pivotal component of the country’s fiscal structure, serving as a primary source of government revenue. The progressive tax slabs, encompassing diverse sources of income, reflect an attempt to distribute the tax burden equitably across various income brackets. The tax system’s intricacies, from deductions to exemptions, provide avenues for individuals to optimize their financial planning and minimize their tax liabilities.

The filing process, though mandatory, is facilitated by online platforms, easing the burden on taxpayers and fostering compliance. However, it is imperative to stay abreast of the ever-evolving tax landscape, as amendments and updates can impact financial strategies. Advance tax obligations and TDS mechanisms further underscore the need for proactive engagement with one’s financial responsibilities.

Nonetheless, the consequences of non-compliance, including penalties, emphasize the importance of adhering to regulatory timelines and accuracy in filing. As the government periodically introduces changes to enhance fiscal efficiency, individuals and entities must remain vigilant to maximize benefits and align with evolving tax norms.

In navigating the complex terrain of Income Tax in India, individuals are encouraged to seek professional advice, ensuring not only compliance but also strategic financial planning tailored to the dynamic tax environment. Ultimately, a nuanced understanding of the income tax system empowers taxpayers to make informed decisions, contributing to both personal financial well-being and the broader economic landscape.

One thought on “What is Income Tax? Latest News, Slab, Penalties, IT Act & Return and Advance Tax 2023”