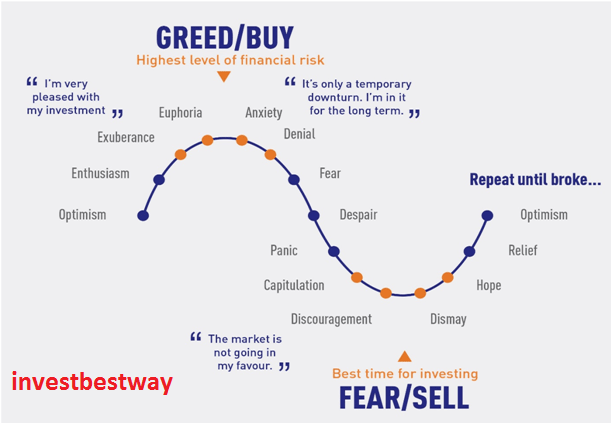

Did you know Greed and fear Index: Meaning work and Swings? Invest in the stock market with your mind or does fear and greed make you invest? The Greed and Fear Index is a powerful tool in the world of finance, encapsulating the ebb and flow of market sentiments. Comprising the two fundamental human emotions that drive financial markets, it reflects the delicate balance between greed and fear. This index gauges investor sentiment, offering insights into the psychological factors influencing market movements.

Greed fuels bullish markets, driving prices higher, while fear triggers sell-offs and market declines. Understanding the dynamics of the Greed and Fear Index is crucial for investors, as it unveils the emotional undercurrents steering financial markets and provides valuable insights into potential market swings.

Don’t worry, you are on right place. We will give you all the information inside this article – What are the thoughts of Warren Buffett and Charles Darwin? How do these feelings work? How to get control over it?

Sense of earning and losing Crores

There are two types of feelings experience by a human being one is success and second is failure. The first of these two is fear and the second is greed.

Both are an internal emotional state. Millions of dollars earned and lost in relationships, business etc. on the basis of these two feelings.

How to get a secured personal loan

Information in Trading Books

If we look at the books related to stock trading, the online courses available in educational courses, what do they sell?

They don’t actually avoid the subject of personal feelings. Rather, they try to strong their emotional side of business by teaching readers some new methods and skills

Skills of Navigate Emotions

We all know that a certain amount of happiness and displeasure can be expressed through emotions. Emotions are associated with a variety of conditions such as mood, state of mind, desire, passion, etc. So do the work of such individuals to develop the skills to navigate emotions in business and life.

The feelings that have been developing in our mind are more than 2 million years old. In reality, emotion is also right to fulfill a purpose.

Charles Darwin thought fear in stock market

If Charles Darwin is to be believed, the decision to blame emotions is not right, the main reason for this could be lack of planning and laziness. Develop your amazing skills, take advantage of them by correcting weak decisions.

Warren Buffet about fear in stock market

If we do not talk about Warren Buffett about this topic, then it would be a betrayal to give complete information. We can understand from his strategy how important it is to stick to a profitable plan.

Warren Buffett stuck to his strategy and is one of the most successful investors of today. Determining the longevity of the company was an important investment guideline for Pett and his partners. He used to make some simple guidelines for whether to invest in any company or not.

If the market overwhelmed by fear, the same thing happen with greed. Successful traders and investors alike make their moves and this is where they make the most money. That’s when the market is fearful about further losses and stocks continue to face big losses for the duration. But getting too scared or fearful at this point can be a big mistake.

Impact of Crypto-currency and War

Greed runs high on the rise of crypto-currencies while business fears run high in the aftermath of war. The game of greed and fear goes on like a cat and mouse. In such a situation, investors quickly turn to other safe investors.

Should retail investors get carried away fearing a big correction? Generally speaking, the value of one’s retirement portfolio is too large to digest or swallow. The flood of money into the stock market completely disregards the new signals from technology. Floods of these headlines make retail investors very happy all the time.

Role of the Flame of Greed

One of the biggest problems with trading and daily decisions is that the investor creates a list of his own needs and wants, rather than a clear understanding of his personal goals, his own sense of success in dreaming others’ dreams, and trying to reach others’ dreams. in which he plays a huge role in extinguishing the flame of his own greed.

I am adding links of some must read books related to my decision making and feelings matter so that my travel experiences will be very beneficial for you. As I will continue to bring such a list for you in which you will get maximum benefit.

FAQ’s

In my Words (Greed and fear Index)

The Greed and Fear Index is a dynamic tool in financial markets that reflects the prevailing sentiments of investors. It combines two fundamental emotions driving market behaviour: greed and fear. This index serves as a barometer for market sentiment, providing valuable insights into potential shifts in the financial landscape.

The meaning of the Greed and Fear Index lies in its ability to quantify investor psychology. When the index is tilted towards greed, it suggests a high level of optimism and risk appetite among investors. Conversely, a dominance of fear signals heightened caution and risk aversion. Understanding this index is crucial for investors seeking to navigate the unpredictable waters of the financial markets.

The workings of the Greed and Fear Index are rooted in various market indicators, ranging from volatility measures to put-call ratios. By synthesizing these factors, the index offers a comprehensive snapshot of the market sentiment at any given moment. Investors can leverage this information to make informed decisions about their portfolios.

The swings in the Greed and Fear Index are reflective of the dynamic nature of financial markets. As economic conditions, geopolitical events, and global uncertainties evolve, so does the index. Large swings indicate rapid shifts in investor sentiment, potentially signalling impending market movements. Traders and investors can use these fluctuations as a gauge to adjust their strategies accordingly.

In conclusion, the Greed and Fear Index is a powerful tool that encapsulates the ebb and flow of market sentiment. Its meaning lies in its ability to distil complex emotions into a tangible metric, providing market participants with valuable insights. By understanding how the index works and interpreting its swings, investors can enhance their decision-making processes and navigate the ever-changing landscape of financial markets with greater confidence.

I believe that the most helpful thing in any success is that in what proportion he has measured success, money, goal and happiness in his success. Happiness is greatly and easily influenced by external factors. As in present times it is very easy to find happiness on social media. This happiness is temporary. The real happiness must be within the individual’s self.

One thought on “Greed and fear Index: Meaning, work and Swings 2023”