Introduction Causes of Inflation 2023

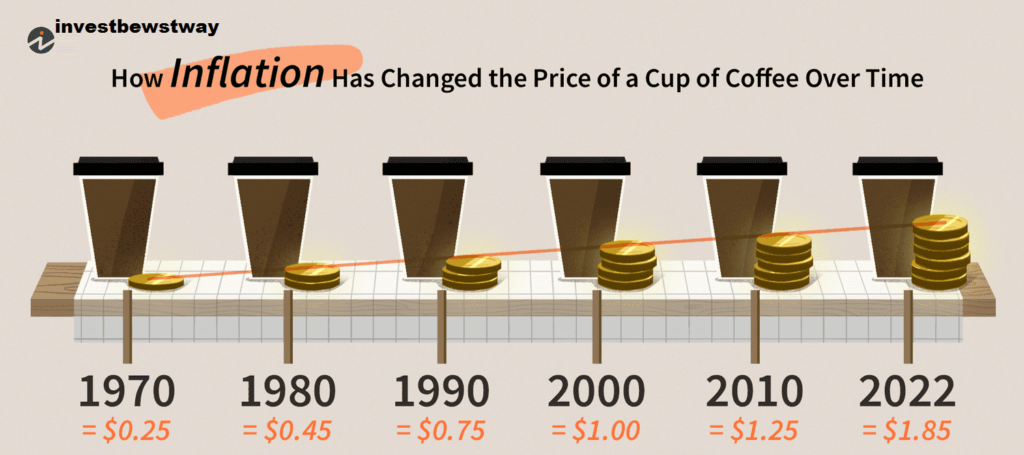

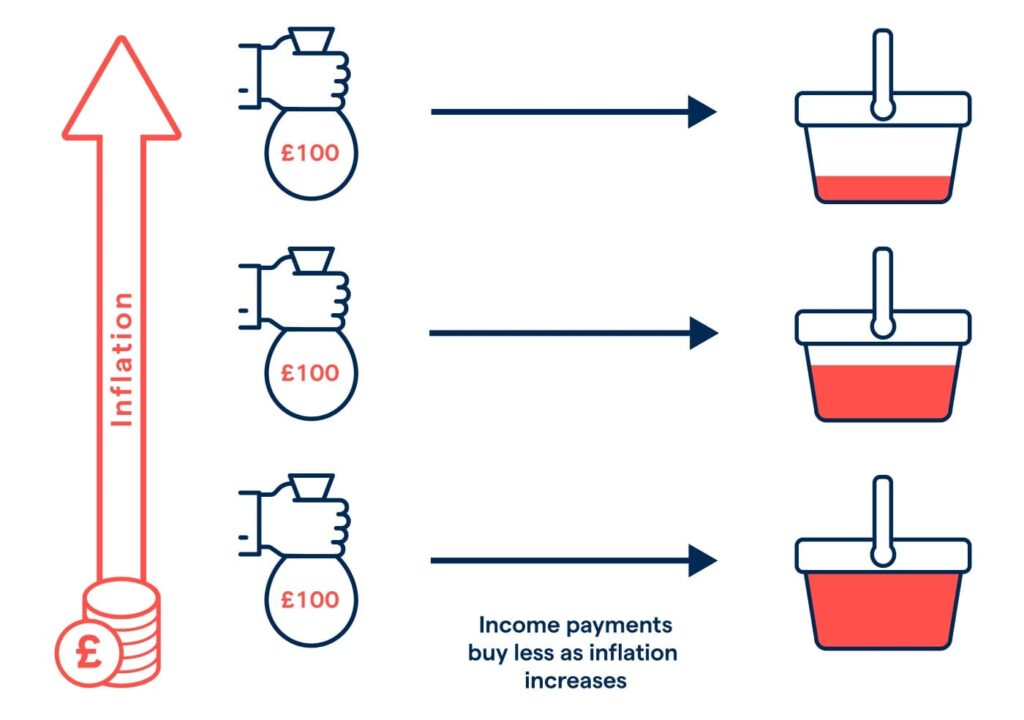

Inflation is a consistent increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power of money. A variety of factors can causes of inflation, including an increase in the money supply, a decrease in the supply of goods and services, and an increase in production costs.

11 11 Most Popular Causes of Inflation 2023!

- Food and Groceries

- Housing

- Transportation

- Healthcare

- Education

- Commodities

- Real Estate

- Consumer Discretionary

- Utilities

- Financials

- Technology Healthcare

There are several areas where we feel inflation, and it is important to understand these areas to better understand the impact of inflation on our daily lives. In this article, we will discuss five areas where we feel inflation. Here are some sectors that are commonly causes of Inflation:

What is secured personal loan?- Process, Features and Eligibility

Food and Groceries

One of the most obvious areas where we feel inflation is in the cost of food and groceries. The prices of food and groceries are directly causes of Inflation, as they are affected by the increase in production costs and the decrease in the supply of goods and services.

The prices of food and groceries are also affected by the cost of transportation and storage, as well as by the demand for certain products. For example, the price of meat is affected by the cost of feed for animals, as well as by the demand for meat.

Housing

Another area where we feel inflation is in the cost of housing. The cost of housing is affected by inflation, as it is affected by the increase in production costs and the decrease in the supply of goods and services.

The cost of housing is also affected by the cost of land and construction materials, as well as by the demand for housing. For example, the cost of a house is affected by the cost of land, as well as by the demand for housing in a particular area.

Transportation

Another area where we feel inflation is in the cost of transportation. The cost of transportation is affected by inflation, as it is affected by the increase in production costs and the decrease in the supply of goods and services.

The cost of transportation is also affected by the cost of fuel and the cost of maintenance. For example, the cost of gas is affected by the price of oil, as well as by the cost of refining and distributing the gas.

Healthcare

Another area where we feel inflation is in the cost of healthcare. The cost of healthcare is causes of Inflation, as it is affected by the increase in production costs and the decrease in the supply of goods and services.

The cost of healthcare is also affected by the cost of drugs and medical equipment, as well as by the demand for healthcare services. For example, the cost of a doctor’s visit is affected by the cost of drugs and medical equipment, as well as by the demand for healthcare services.

Education

Another area where we feel inflation is in the cost of education. The cost of education is causes of Inflation, as it is affected by the increase in production costs and the decrease in the supply of goods and services.

The cost of education is also affected by the cost of books and equipment, as well as by the demand for education. For example, the cost of tuition is affected by the cost of books and equipment, as well as by the demand for education in a particular area.

4 Best Options To Get A Loan With Bad Credit Score

Commodities

Benefit Commodities like gold, silver, and other precious metals often act as a hedge against inflation. As the purchasing power of currency declines, the value of tangible assets like commodities may rise.

Challenge Rising inflation can also lead to increased production costs for commodities, affecting profit margins for businesses in this sector.

Real Estate

Benefit Real estate is often considered a hedge against inflation. As the cost of living increases, so does the value of real property. Additionally, real estate investments can provide a stream of rental income that may adjust with causes of Inflation.

Challenge High inflation can lead to higher interest rates, making borrowing more expensive and potentially slowing down the real estate market.

Consumer Discretionary

Benefit some consumer discretionary sectors, such as luxury goods and entertainment, may see increased demand during periods of inflation as consumers may allocate more of their income to non-essential items.

Challenge Rising prices can also lead to decreased consumer spending on discretionary items as individuals may prioritize essential purchases.

Utilities

Challenge Utilities often face challenges during inflationary periods due to the potential for higher interest rates. Since many utility companies carry significant debt, increased interest rates can elevate their borrowing costs.

Financials

Benefit Financial institutions can benefit from inflation if they can charge higher interest rates on loans. As the cost of borrowing increases, financial institutions may see improved profit margins.

Challenge however, if inflation leads to higher interest rates across the board, it can also increase the cost of funds for financial institutions, impacting their profitability.

Technology

Benefit Technology companies may fare well during inflationary periods, as they often have high-profit margins and may not be as capital-intensive as other sectors.

Challenge If inflation leads to higher interest rates, it can increase the discount rate used to value future cash flows, potentially impacting the valuation of technology stocks.

Healthcare

Mixed Impact Healthcare is a mixed bag during inflation. While it is a necessity, rising costs of healthcare services and products can pose challenges for both consumers and healthcare companies.

Understanding how inflation affects different sectors is crucial for investors and businesses to make informed decisions and navigate economic uncertainties. The causes of Inflation can also vary depending on the specific circumstances and the overall economic environment.

5 Areas Where Interest Rates Affect the Real Economy

FAQ’s

In conclusion for causes of Inflation

inflation! is a consistent increase in the general price level of goods and services in an economy over a period of time. There are several causes of Inflation, including food and groceries, housing, transportation, healthcare, and education.

It is important to understand these areas to better understand the impact of causes of Inflation on our daily lives. Inflation can be caused by a variety of factors, including an increase in the money supply, a decrease in the supply of goods and services, and an increase in production costs.

One thought on “11 Most Popular Causes of Inflation 2023”