Introduction to Axis Bank Personal Loan

Axis Bank Personal loans play a pivotal role in fulfilling the aspirations and financial needs of individuals. They provide a flexible financial solution without the need for collateral, making them particularly attractive for those seeking immediate funds.

A. Overview of Axis Bank:

Axis Bank, one of India’s leading private sector banks, offers a comprehensive range of financial products, including personal loans tailored to meet the diverse needs of its customers. Established in 1993, Axis Bank has emerged as a trusted institution known for its innovation and customer-centric approach. Axis Bank’s personal loans are designed to provide financial solutions that cater to various purposes such as education, travel, medical expenses, or any unforeseen financial requirements.

The bank’s extensive network of branches and digital platforms ensures accessibility for individuals across the country. With a commitment to delivering quality banking services, Axis Bank has earned a reputation for its robust infrastructure, technological prowess, and a customer-centric mind-set. The bank’s adherence to ethical banking practices contributes to its standing in the financial industry.

B. Importance of Personal Loan

Personal loans play a pivotal role in fulfilling the aspirations and financial needs of individuals. They provide a flexible financial solution without the need for collateral, making them particularly attractive for those seeking immediate funds. Axis Bank recognizes the significance of personal loans in empowering individuals to achieve their goals, whether it’s funding a dream vacation, covering medical expenses, or supporting educational pursuits.

The importance of personal loans extends beyond mere financial assistance; they contribute to enhancing the overall quality of life by offering a convenient way to manage unexpected expenses or pursue personal milestones. In a dynamic economy, personal loans empower individuals to bridge financial gaps and seize opportunities without disrupting their long-term financial plans.

Axis Bank’s commitment to providing personalized and hassle-free personal loan solutions underscores the bank’s recognition of the pivotal role such financial instruments play in the lives of its customers. As we delve deeper into the specifics of Axis Bank’s personal loans, we’ll uncover the features and benefits that make them a preferred choice for many.

What is secured personal loan?- Process, Features and Eligibility

Understanding Axis Bank Personal Loan Features

This ensures that they are getting a competitive deal and helps in making an informed financial decision.

A. Eligibility Criteria:

Axis Bank sets specific eligibility criteria for individuals seeking a personal loan. These criteria typically include factors such as age, income, employment stability, and credit history. Applicants must meet these requirements to qualify for a personal loan from Axis Bank. Understanding and fulfilling these criteria is crucial for a successful loan application.

B. Loan Amount and Tenure:

1. Loan Amount:

Axis Bank offers a range of loan amounts to cater to diverse financial needs. The amount granted depends on factors like the applicant’s income, creditworthiness, and existing financial obligations. Exploring the available loan amounts allows borrowers to choose an amount that aligns with their requirements.

2. Loan Tenure:

The tenure of an Axis Bank personal loan refers to the duration for which the borrower will repay the loan. Axis Bank typically provides flexible repayment options, allowing borrowers to select a tenure that suits their financial capabilities. Longer tenures might result in lower monthly installments, while shorter tenures may lead to higher but quicker repayments.

Quick Home Equity Loan: 6 Tips to Get in seconds

C. Interest Rates:

1. Fixed vs. Floating Rates:

Axis Bank offers personal loans with either fixed or floating interest rates. Understanding the difference is crucial for borrowers. Fixed rates remain constant throughout the loan tenure, providing predictability, while floating rates may change based on market fluctuations.

2. Factors Influencing Interest Rates:

Axis Bank determines interest rates based on factors such as the applicant’s credit score, income, and existing debts. A higher credit score often results in a lower interest rate. Exploring and comparing these rates helps borrowers make informed decisions.

D. Processing Fees:

Axis Bank charges processing fees for handling the loan application and related paperwork. This fee is a one-time payment and is deducted from the loan amount at the time of disbursal. Understanding the processing fees is crucial for budgeting and ensuring that applicants are aware of the total cost associated with the loan.

1. Transparency in Fees:

Axis Bank is known for transparent fee structures. It is essential for borrowers to be aware of the processing fees upfront to avoid any surprises during the loan disbursal process.

2. Fee Comparisons:

Before finalizing a personal loan with Axis Bank, applicants should compare processing fees with those of other lenders. This ensures that they are getting a competitive deal and helps in making an informed financial decision.

4 Best Options To Get A Loan With Bad Credit Score

Application Process for Axis Bank Personal Loans

Axis Bank’s personal loan application process encompasses a seamless online application, meticulous documentation submission, a comprehensive verification stage, and timely disbursement of approved loan amounts. Prospective borrowers are encouraged to adhere to the specified guidelines and provide accurate information to ensure a smooth and swift processing of their personal loan applications.

A. Online Application

Axis Bank streamlines the personal loan application process through a user-friendly online platform. Prospective borrowers can visit the official website or use the mobile banking app to initiate the application. The online application form typically requires essential personal and financial details, ensuring a convenient and time-efficient submission process.

B. Documentation Required

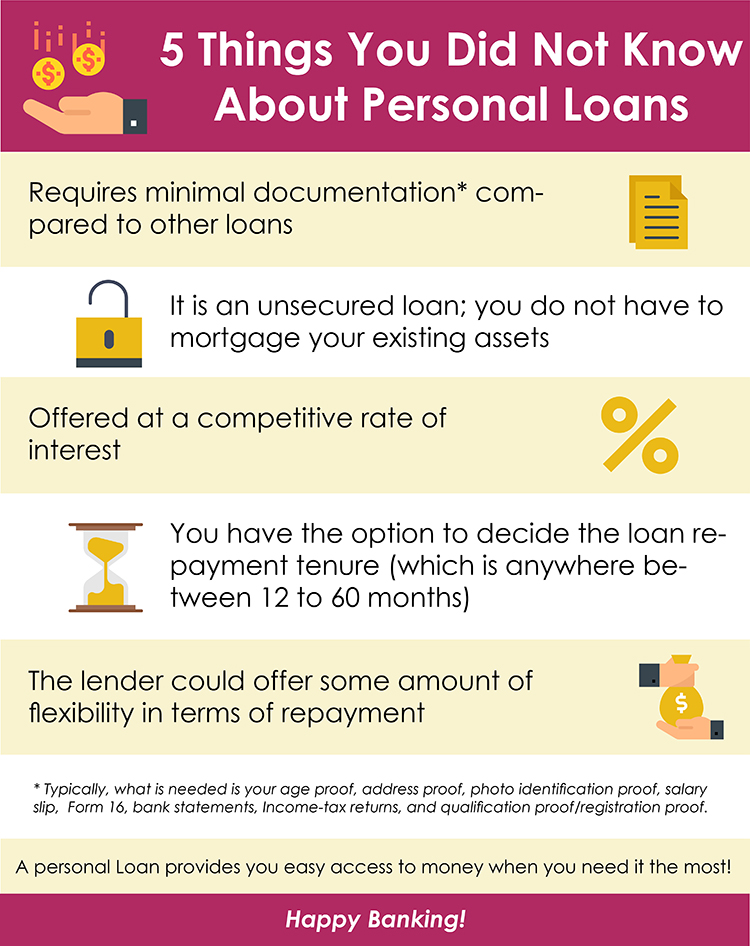

To support the online application, applicants need to submit a set of necessary documents. These documents often include proof of identity, residence, income, and employment. The bank may specify documents such as Aadhar card, PAN card, salary slips, bank statements, and other relevant proofs. Ensuring the accurate and complete submission of these documents is crucial for a smooth application process.

C. Verification Process

Once the application and required documents are submitted, Axis Bank initiates a thorough verification process. This involves validating the information provided by the applicant. The bank may conduct background checks, verify employment details, and assess the applicant’s creditworthiness. Timely and accurate information during this stage contributes significantly to a faster and more efficient processing of the personal loan application.

D. Disbursement

Upon successful completion of the verification process, Axis Bank proceeds with the disbursement of the personal loan. The approved loan amount is credited directly to the borrower’s bank account. The disbursement process is designed to be prompt, allowing borrowers quick access to the funds for their intended purposes. Axis Bank often provides various disbursement options, and the chosen method is communicated to the borrower during the application process.

How to Get Cheap and Best Bank Personal Loan in 2023

Advantages of Choosing Axis Bank Personal Loans

Choosing Axis Bank for a personal loan brings the advantages of competitive interest rates, flexible repayment options, and a quick approval process, making it a compelling choice for individuals seeking financial support with favorable terms and conditions.

A. Competitive Interest Rates:

Axis Bank offers personal loans with highly competitive interest rates, making them an attractive option for borrowers. The bank frequently reviews and adjusts its interest rates to stay competitive in the market. Borrowers can benefit from lower interest costs, resulting in more affordable loan repayments over the tenure.

The competitive interest rates are determined based on factors such as the applicant’s credit score, income, and loan amount. This ensures that borrowers with a strong financial profile receive preferential rates, encouraging responsible financial behavior.

B. Flexible Repayment Options:

Axis Bank stands out by providing a range of flexible repayment options tailored to the diverse needs of borrowers. Borrowers can choose from various repayment tenures, allowing them to align the loan repayment schedule with their financial capabilities. This flexibility enables individuals to manage their monthly budgets more effectively and choose a repayment plan that suits their lifestyle.

Additionally, Axis Bank may offer features such as part-prepayment and foreclosure options without imposing significant penalties. This gives borrowers the freedom to repay their loans ahead of schedule, saving on interest costs and providing financial freedom.

C. Quick Approval Process:

One of the key advantages of opting for an Axis Bank personal loan is the quick approval process. Axis Bank has streamlined its loan approval procedures to ensure a swift and efficient experience for borrowers. The bank leverages advanced technology and data analytics to expedite the verification and approval processes.

Applicants can expect a faster turnaround time from the loan application submission to approval, which is particularly beneficial in urgent financial situations. The quick approval process reflects Axis Bank’s commitment to providing timely financial assistance to its customers, enhancing the overall customer experience.

Consider Before Applying for Axis Bank Personal Loan

Understanding these details ensures that you are fully aware of the commitments and responsibilities associated with the personal loan, avoiding any surprises during or after the application process.

A. Financial Assessment:

- Before applying for an Axis Bank personal loan, conduct a thorough financial assessment.

- Evaluate your income, monthly expenses, and existing financial obligations to determine your repayment capacity.

- Consider factors such as job stability, future income prospects, and any potential changes in financial circumstances.

- Use online calculators provided by Axis Bank to estimate your loan eligibility and monthly EMI payments.

- This assessment ensures that you apply for a loan amount that aligns with your financial capabilities, reducing the risk of repayment challenges.

B. Comparison with Other Lenders:

- Research and compare personal loan offerings from different financial institutions, not just Axis Bank.

- Consider interest rates, processing fees, and tenure options offered by various lenders.

- Look into customer reviews and feedback to gauge the reputation and customer service of different banks.

- Pay attention to any special features or benefits provided by Axis Bank that may differentiate it from competitors.

- A comprehensive comparison allows you to make an informed decision and choose a lender that best suits your financial needs.

C. Understanding Terms and Conditions:

- Carefully read and understand the terms and conditions associated with Axis Bank personal loans.

- Focus on interest rates, processing fees, prepayment charges, and any other applicable fees.

- Clarify the loan tenure options and assess the flexibility offered in repayment schedules.

- Pay attention to any special conditions or requirements that may impact your eligibility or the loan process.

- Seek clarification from Axis Bank representatives for any aspects of the terms and conditions that are unclear.

Axis Bank Official Website – Click Here

Personal loan and features – ClickHere

All Official Data in Simple Format – Click Here

Home Loan in 2023: Process, Fees and Time of Approval

Customer Experiences with Axis Bank Personal Loans

This information aids potential borrowers in making informed decisions and selecting a financial institution that aligns with their preferences and requirements. Reviewing testimonials, ratings, and feedback from various sources provides a holistic understanding of customer experiences with Axis Bank personal loans.

A. Testimonials

Testimonials provide valuable insights into the real-life experiences of individuals who have availed Axis Bank personal loans. These accounts offer a glimpse into the customer journey, highlighting aspects such as customer service, loan processing efficiency, and overall satisfaction. Axis Bank may showcase positive testimonials on its official website, reflecting the positive impact of their personal loan services on borrowers’ lives. These personal stories can influence potential customers by instilling confidence in the bank’s reliability and customer-centric approach.

B. Reviews and Ratings

1. Online Platforms:

Explore reviews on popular online platforms such as banking forums, financial websites, and social media channels. Customers often share their experiences, detailing the application process, interest rates, and customer service interactions. Positive reviews can build trust, while negative ones may highlight areas for improvement.

2. Third-Party Review Sites:

Check reputable third-party review sites that specialize in financial services. These platforms aggregate user reviews and assign ratings based on various criteria. Examining these reviews can provide a comprehensive overview of the strengths and weaknesses of Axis Bank’s personal loan offerings.

3. Customer Satisfaction Surveys:

Axis Bank may conduct customer satisfaction surveys to gather feedback directly. Analyzing survey results can offer insights into specific aspects of personal loan services that customers appreciate or find lacking. Understanding the average customer satisfaction score can be indicative of the overall quality of service.

4. Complaint Resolution:

Evaluate how Axis Bank addresses and resolves customer complaints. A responsive and effective complaint resolution process is essential for customer satisfaction. Monitoring how the bank handles negative feedback demonstrates its commitment to improving services and addressing customer concerns.

5. Comparisons with Competitors:

Compare Axis Bank’s reviews and ratings with those of its competitors. This comparative analysis can help potential borrowers make informed decisions by assessing how Axis Bank stacks up against others in the industry.

Tips for a Smooth Loan Process

1. Check Your Credit Score:

Ensure your credit score is in good standing before applying. A higher credit score increases the likelihood of loan approval and better interest rates.

2. Evaluate Your Financial Situation:

Assess your financial situation to determine the loan amount you genuinely need and can comfortably repay.

3. Gather Necessary Documents:

Collect all required documents such as income proof, identity proof, and address proof to expedite the application process.

4. Compare Loan Offers:

Before finalizing, compare Axis Bank’s personal loan offerings with those of other lenders to ensure you are getting the most favorable terms.

5. Understand Terms and Conditions:

Read and comprehend the terms and conditions of the loan agreement to avoid misunderstandings later. Seek clarification on any unclear points.

6. Maintain a Stable Employment History:

A stable employment history positively influences your loan application. Lenders often prefer borrowers with consistent income sources.

7. Avoid Multiple Loan Applications Simultaneously:

Submitting multiple loan applications at the same time can negatively impact your credit score. Apply to multiple lenders strategically.

8. Plan Your Repayment Strategy:

Have a clear repayment plan in place. Understanding your EMIs and budgeting accordingly ensures a smooth repayment process.

9. Stay Informed About Fees:

Be aware of all fees associated with the loan, including processing fees and prepayment charges. This knowledge helps you plan your finances effectively.

10. Communicate with the Bank:

If you face any challenges during the loan tenure, such as financial difficulties or changes in employment, proactively communicate with Axis Bank to explore possible solutions.

Indusind Bank Credit Card Details and Benefits 2023

Axis Bank Personal Loan FAQs

Common Questions which are frequently asked by customers, who want to take loan.

1. What are eligibility criteria for Axis Bank Personal Loans?

Axis Bank typically considers factors such as age, income, employment stability, and credit history. Meeting these criteria enhances your chances of loan approval.

2. How much can I borrow through an Axis Bank Personal Loan?

The loan amount varies based on your eligibility and financial profile. Axis Bank offers a wide range of loan amounts to cater to diverse financial needs.

3. What is the interest rate charged on Axis Bank Personal Loans?

Axis Bank’s interest rates are competitive and depend on factors like credit score, loan amount, and tenure. It’s advisable to check the prevailing rates before applying.

4. What is the repayment tenure for Axis Bank Personal Loans?

The repayment tenure is flexible and can range from 12 to 60 months. You can choose a tenure that aligns with your financial capabilities.

5. Is collateral required for Axis Bank Personal Loans?

No, Axis Bank Personal Loans are unsecured, meaning you don’t need to provide collateral. This makes the application process faster and more straightforward.

6. How long does it take for Axis Bank to approve a personal loan application?

The approval time varies, but Axis Bank is known for a quick processing turnaround. It’s advisable to have all necessary documents ready for a smoother process.

7. Are there any additional charges apart from the interest rate?

Yes, processing fees and other charges may apply. Understanding the complete fee structure is crucial to avoid surprises during the loan tenure.

8. Can I prepay or foreclose my Axis Bank Personal Loan?

Yes, Axis Bank allows prepayment and foreclosure of personal loans. However, some charges may be applicable, and it’s important to be aware of these before deciding to prepay.

9. What happens if I miss an EMI payment?

Missing an EMI payment can lead to penalties and negatively impact your credit score. It’s advisable to communicate with the bank if you anticipate any issues with repayments.

10. Is it possible to track the status of my Axis Bank Personal Loan application online?

Yes, Axis Bank provides online tracking services. Applicants can monitor the status of their loan application through the bank’s official website or customer portal.

What is Income Tax? Latest News, Slab, Penalties, IT Act & Return and Advance Tax 2023

Conclusion in My Words of Axis Bank Personal Loan

Axis Bank stands out as a trusted institution, providing not just loans but a comprehensive financial solution that aligns with the diverse needs of its customers. Consider Axis Bank for your personal loan requirements and embark on a journey of financial empowerment with a reliable banking partner.

Axis Bank Personal Loans offer a compelling array of features tailored to meet diverse financial needs. With a customer-centric approach, the bank ensures a seamless borrowing experience. The eligibility criteria are flexible, catering to a wide range of applicants. Whether it’s for a dream vacation, home renovation, or medical expenses, Axis Bank provides substantial loan amounts with reasonable interest rates.

The loan tenure options accommodate various repayment preferences, allowing borrowers to align their EMIs with their financial capabilities. Additionally, the transparent fee structure, including processing fees, ensures clarity throughout the borrowing process. Axis Bank’s commitment to quick processing and disbursal further enhances the appeal of its personal loans.

In conclusion, choosing Axis Bank for a personal loan is a prudent financial decision. The bank’s reputation for reliability and efficiency is reflected in its personal loan offerings. Competitive interest rates and flexible repayment terms position Axis Bank as a favorable choice among borrowers. The straightforward application process, supported by a robust online platform, adds to the overall convenience.

Furthermore, Axis Bank’s commitment to customer satisfaction is evident in the positive reviews and testimonials from borrowers. The bank’s adherence to ethical practices and transparency in dealings instills confidence among applicants. When seeking a personal loan, opting for Axis Bank ensures not only financial support but also a partner that values customer well-being.

In essence, Axis Bank stands out as a trusted institution, providing not just loans but a comprehensive financial solution that aligns with the diverse needs of its customers. Consider Axis Bank for your personal loan requirements and embark on a journey of financial empowerment with a reliable banking partner.

One thought on “Axis Bank Personal Loan Instant Apply & Approved 2023”