About the Post

Are you facing problems in getting various informations about Indusind bank credit card?

Now Relax, Credit cards of various banks were researched by our experts. The credit card of Indusind Bank is at the top among us.

Now you are in the right place. We will provide you all the information related to credit card.

IndusInd Bank Credit Card – Applying

IndusInd Bank offers a range of credit cards with diverse features and benefits. If you’re interested in applying for an IndusInd Bank credit card, follow these steps:

1. Eligibility Criteria

Get started by filling in basic details such as your PAN number, Mobile No and Email ID and do a quick e-KYC to confirm your address details etc. On completing the application, you can expect to receive your card within 24-48 hours.

Apply for Credit Card with IndusInd Bank and enjoy exclusive memberships and discounts on dining, travel, online retail, entertainment and much more.

2. Choose the Right Card

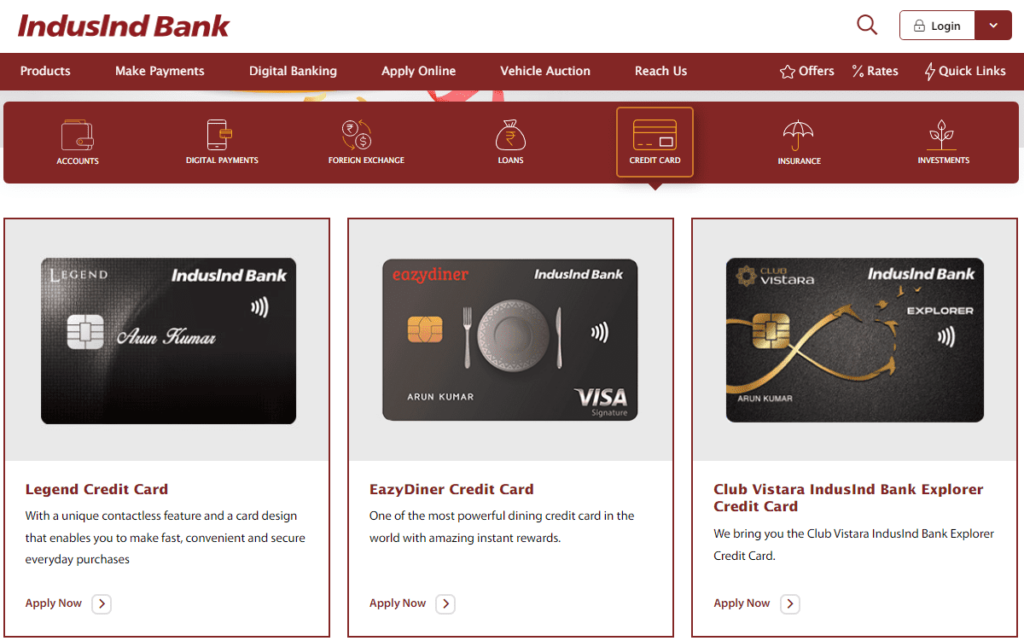

Explore the various credit cards offered by IndusInd Bank and choose one that aligns with your spending habits and lifestyle.

3. Application Process

Visit the official IndusInd Bank website or approach a local branch to access the credit card application form. Fill in the required details, including personal information, contact details, employment details, and financial information.

4. Submission of Documents

Submit the necessary documents, such as identity proof, address proof, income proof, and passport-size photographs.

5. Verification Process

The bank will verify your application and documents. Ensure that all the information provided is accurate to expedite the process.

6. Credit Check

IndusInd Bank will conduct a credit check to assess your creditworthiness. A good credit score enhances your chances of approval.

7. Approval and Dispatch

Upon approval, the bank will dispatch the credit card to your registered address. You will also receive a communication regarding your credit limit.

8. Activation

Once you receive the credit card, follow the instructions to activate it. This often involves sending an SMS or making a call to a designated number.

9. Online Account Access

Register for online banking to manage your credit card account, view statements, and access various services.

How to Get Maximum Benefits of Credit Card 2023

IndusInd Bank Credit Card Status

IndusInd Bank offers a variety of credit cards catering to different needs and preferences. Checking the status of your IndusInd Bank credit card application is a straightforward process. Here’s a step-by-step guide:

1. Online Portal

- Visit the official IndusInd Bank website.

- Navigate to ”Card” under Product section.

- Here you Click on ‘Credit Cards’.

- Look for the ‘Check Application Status’ option.

- Enter the required details (such as application reference number or application form number).

- Click on ‘Submit’ to view the current status.

2. Customer Care

Contact the IndusInd Bank customer care helpline number 18602677777 available 24 Hours. Provide the necessary details like your application reference number or any information requested. The customer care representative will assist you in checking the status of your credit card application.

3. SMS Service

Send an SMS in the prescribed format (usually “STAT <Application Reference Number>”) to the designated number provided by the bank. You will receive an automated response with the current status of your credit card application.

4. Email Service

You can write your problem at premium.care@indusind.com. Always ensure you have the relevant information at hand when checking the status. If the application is approved, you can expect the card to be delivered to your registered address.

IndusInd Bank Credit Card PIN Generating

After receiving your IndusInd Bank credit card, the next step is to generate a Personal Identification Number (PIN). Here’s how you can do it:

1. SMS or Helpline

Here are two situations: First is you receive a PIN along with the credit card, and second is you may receive an SMS containing instructions on PIN generation or a helpline number to call.

2. Online Banking

Log in to your IndusInd Bank online banking account. Navigate to the credit card section, where you may find an option to generate or change your PIN.

3. Mobile App

If the bank has a mobile app, check whether there’s an option to generate your credit card PIN. This is often a user-friendly method.

4. ATM

Visit any IndusInd Bank ATM, insert your credit card, and follow the on-screen prompts to generate a new PIN.

5. Customer Service

You can also contact IndusInd Bank’s customer service for assistance in generating your credit card PIN.

6. Security Measures

Ensure that your PIN is known only to you. Do not share it with anyone, and avoid using easily guessable combinations.

By following these steps, you can successfully apply for an IndusInd Bank credit card and generate a secure PIN to start using it for your financial transactions.

Home Loan in 2023: Process, Fees and Time of Approval

IndusInd Bank Credit Card Login

IndusInd Bank provides its customers with a convenient online platform for managing their credit cards. Follow these steps for a seamless credit card login:

1. Visit the Official Website – IndusInd Bank

2. Select ‘Credit Card Login’

Click on the ‘Credit Card Login’ option. This will direct you to the login portal.

3. Enter Credentials

Provide your user ID and password. Ensure the information is accurate to avoid login issues.

4. One-Time Password (OTP)

Some logins may require an OTP sent to your registered mobile number. Enter the OTP to verify your identity.

5. Access Account

Once authenticated, you can access your IndusInd Bank credit card account. Here, you can view statements, check balances, pay bills, and manage various card-related activities.

Always remember to log out after your session to maintain account security.

IndusInd Bank Credit Card Customer Care Number

IndusInd Bank offers customer support to address queries, resolve issues, and provide assistance regarding credit cards. Here are the details for reaching IndusInd Bank Credit Card Customer Care:

1. Customer Care Number

Dial the dedicated customer care number for credit card-related queries. IndusInd Bank customer care number is 1860 267 7777.

2. International Helpline

If you are calling from abroad, you can reach the bank at +91 22 4220 7777.

3. Interactive Voice Response (IVR)

Follow the IVR prompts to connect to the appropriate department for credit card assistance.

4. 24×7 Assistance

IndusInd Bank’s credit card customer care is available 24×7, ensuring that you can seek assistance at any time.

5. Email Support

For non-urgent queries or documentation submissions, you can also contact the bank through email at

- reachus@indusind.com.

- premium.care@indusind.com

Always have your credit card details and personal information ready when contacting customer care for a more efficient resolution to your queries or concerns. It’s advisable to check the official website or contact the bank for the most up-to-date contact information.

Quick Home Equity Loan: 6 Tips to Get in seconds

IndusInd Bank Credit Card Benefits

IndusInd Bank Credit Cards offer a range of benefits designed to cater to diverse financial needs and lifestyles. Here’s an in-depth look at the key advantages:

- Reward Programs

- Lifestyle Privileges

- Travel Benefits

- Cashback Offers

- Fuel Surcharge Waiver

- EMI Options

- Concierge Services

- Zero Annual Fee Cards

- EMV Chip Security

- Co-branded Cards

Understanding these benefits allows potential and existing IndusInd Bank credit cardholders to maximize the utility of their cards based on their preferences and lifestyle.

IndusInd Bank Credit Card Statement

IndusInd Bank provides monthly credit card statements to keep cardholders informed about their transactions, outstanding balances, and other important details. Here’s a breakdown of the credit card statement: Click here to Download Indusind Bank Credit Card Statement disclosure.

- Transaction Details

- Payment Due Date

- Outstanding Balance

- Credit Limit and Available Credit

- Interest Charges

- Minimum Amount Due

- Rewards Summary

- Fees and Charges

- Contact Information

Understanding credit card statements is essential for effective financial management. Cardholders should review their statements regularly to ensure accuracy, track expenses, and take advantage of available benefits.

What is secured personal loan?- Process, Features and Eligibility

FAQ’s

IndusInd Bank Registered Office Address

IndusInd Bank Limited, 2401 Gen. Thimmayya Road (Cantonment), Pune-411 001, India

Tel: 020-26343201/ 020-69019000 CIN:L65191PN1994PLC076333.

For any Shareholder’s queries or grievances contact Mr. Raghunath Poojary at investor@indusind.com